More Option

S&P 500 INDEX

The S&P 500 Index, is a stock market index that measures the performance of 500 of the largest publicly traded companies in the United States. It's a widely recognized and commonly used benchmark for the overall performance of the U.S. stock market.

-

Composition

Composition

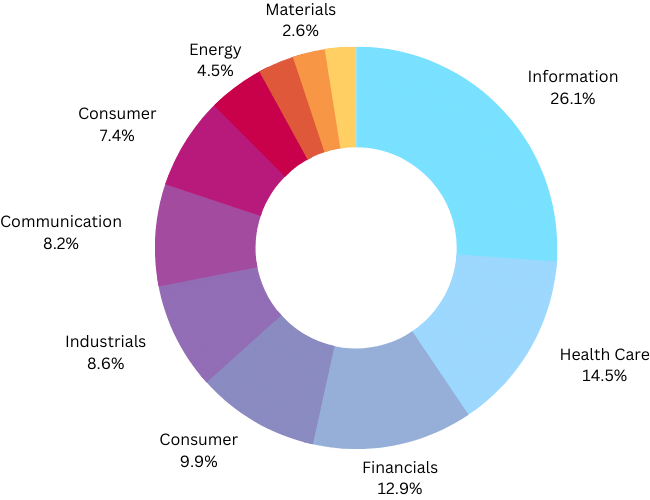

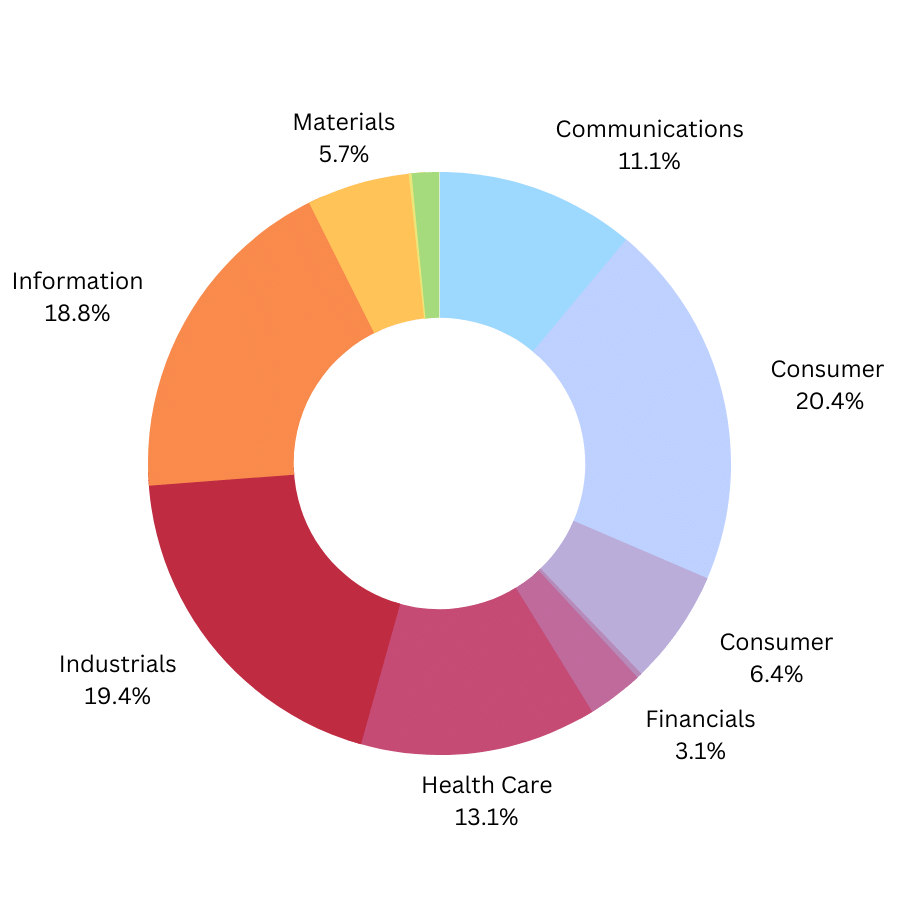

The index includes a diverse selection of companies from various sectors of the economy, such as technology, finance, healthcare, consumer goods, and more. These companies are chosen based on factors like market capitalization, liquidity, and sector representation.

-

Market

Market Capitalization Weighted

The S&P 500 is a market capitalization weighted index. This means that companies with larger market values have a greater influence on the index's movement.

-

Performance

Performance Indicator

The index is used to gauge the overall health and direction of the U.S. stock market. Changes in the index value are often seen as a reflection of investor sentiment and economic conditions.

-

Investment Vehicle

Investment Vehicle

The S&P 500 is used as the basis for various financial products, including exchange-traded funds (ETFs) and mutual funds. These investment products allow investors to gain exposure to the entire index or a portion of it.

-

Calculation

Calculation

The index is calculated by Standard & Poor's, a division of S&P Global. It takes into account the market capitalization of its constituent companies and adjusts for changes such as stock splits and new additions.

-

Representation

Representation

While it's a broad indicator of the U.S. stock market, the S&P 500 is not an exhaustive representation of all U.S. companies. There are other indices, such as the Russell 2000, that represent smaller companies.

DAX (The German stock Index)

The DAX Index, short for "Deutscher Aktienindex," is the primary stock market index of the Frankfurt Stock Exchange in Germany. It represents the performance of the 30 largest and most liquid publicly traded companies listed on the exchange. The DAX is widely used by investors, traders, and financial analysts to gauge the performance of German stocks and the broader economy. It serves as a benchmark for investment performance and helps market participants understand trends and fluctuations in the German equities market.

-

Composition

Composition

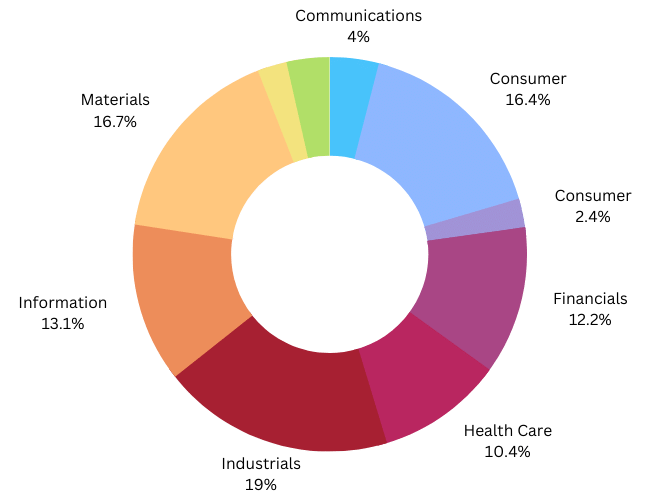

The DAX index consists of 30 carefully selected companies that are leaders in their respective industries. These companies are chosen based on factors such as market capitalization, trading volume, and their overall importance in the German economy. The index's composition is periodically reviewed to ensure it accurately reflects the evolving dynamics of the market.

-

Market

Market Capitalization

The DAX is calculated using a market capitalization-weighted methodology. This means that companies with higher market capitalizations have a greater impact on the index's value. As the stock prices of the constituent companies change, the index value is adjusted accordingly, providing a real-time snapshot of the collective performance of these companies.

-

Performance

Performance Indicator

The DAX serves as a performance indicator for the German stock market. It provides insights into the overall health of the economy, investor sentiment, and market trends. Changes in the DAX are often interpreted as reflections of broader economic conditions and can impact investor confidence both within and outside of Germany.

-

Investment

Investment

The DAX index has practical implications for investors. It offers a benchmark against which investment porƞolios and strategies can be measured. Investors often use financial products Current Sector Weight Information Technology Health Care Consumer Discretionary Communication Services Financials Industrials Consumer Staples Utilities Materials Real Estate Energy like index funds and exchange-traded funds (ETFs) that track the DAX's performance to gain exposure to the German equity market without individually investing in each constituent company.

-

Representation

Representation

The DAX index is a representation of the German corporate landscape. The 30 companies that make up the index encompass a variety of sectors, including finance, manufacturing, technology, pharmaceuticals, and more. As a result, the index's movements can provide valuable insights into the performance of different segments of the German economy.

Nikkei 225 Index

The Nikkei 225 is a stock market index that tracks the performance of 225 publicly traded companies listed on the Tokyo Stock Exchange in Japan. It's one of the most widely followed indices in Japan and serves as a key indicator of the country's stock market and economic conditions.

-

Composition

Composition

The Nikkei 225 index is composed of 225 carefully selected companies listed on the Tokyo Stock Exchange. These companies are chosen based on factors such as market capitalization and liquidity. The index includes a diverse range of industries, providing a representation of various sectors within the Japanese economy.

-

Calculation

Calculation Methodology

The Nikkei 225 is a price-weighted index, which means that the index value is calculated by adding up the stock prices of all 225 constituent companies and then dividing by a divisor. However, unlike other indices that use market capitalization to determine weighting, the Nikkei uses stock prices, giving more influence to higher-priced stocks.

-

Historical

Historical Significance

The Nikkei 225 index holds historical significance due to its association with Japan's economic performance and growth. It was first introduced in 1950 and has since become a widely recognized indicator of the country's economic health and overall market sentiment.

-

Key Market

Key Market Indicator

: The Nikkei 225 serves as a vital market indicator for investors, analysts, and policymakers. Changes in the index reflect shifts in market sentiment, economic conditions, and investor confidence. The Nikkei's movements are often closely monitored to gauge the overall direction of the Japanese stock market.

-

International

International Impact

The Nikkei's influence extends beyond Japan, as its movements can impact global markets. The index is considered an indicator of Asia-Pacific economic trends and can affect investor decisions beyond Japan's borders.

-

Investment

Investment Implications

The Nikkei 225 index has practical implications for investors. It provides a benchmark against which investment porƞolios can be measured. Financial products such as exchange-traded funds (ETFs) and index funds allow investors to gain exposure to the Japanese market's performance without needing to invest in each constituent company individually.

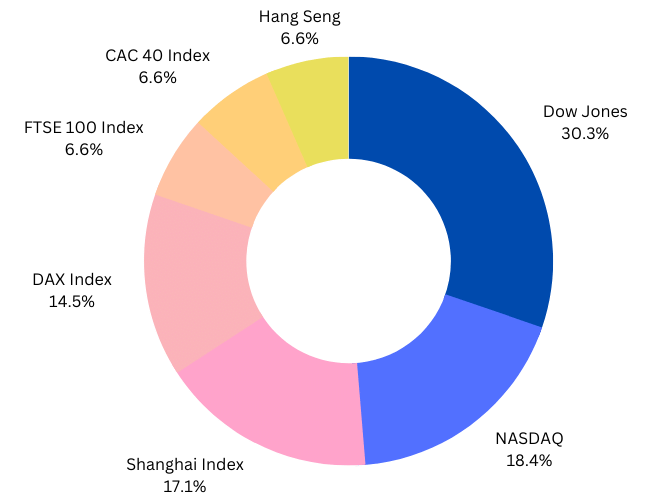

Other Stock Indices

Here are the other indices that we deal with in Stock Market