More Option

USDX Index

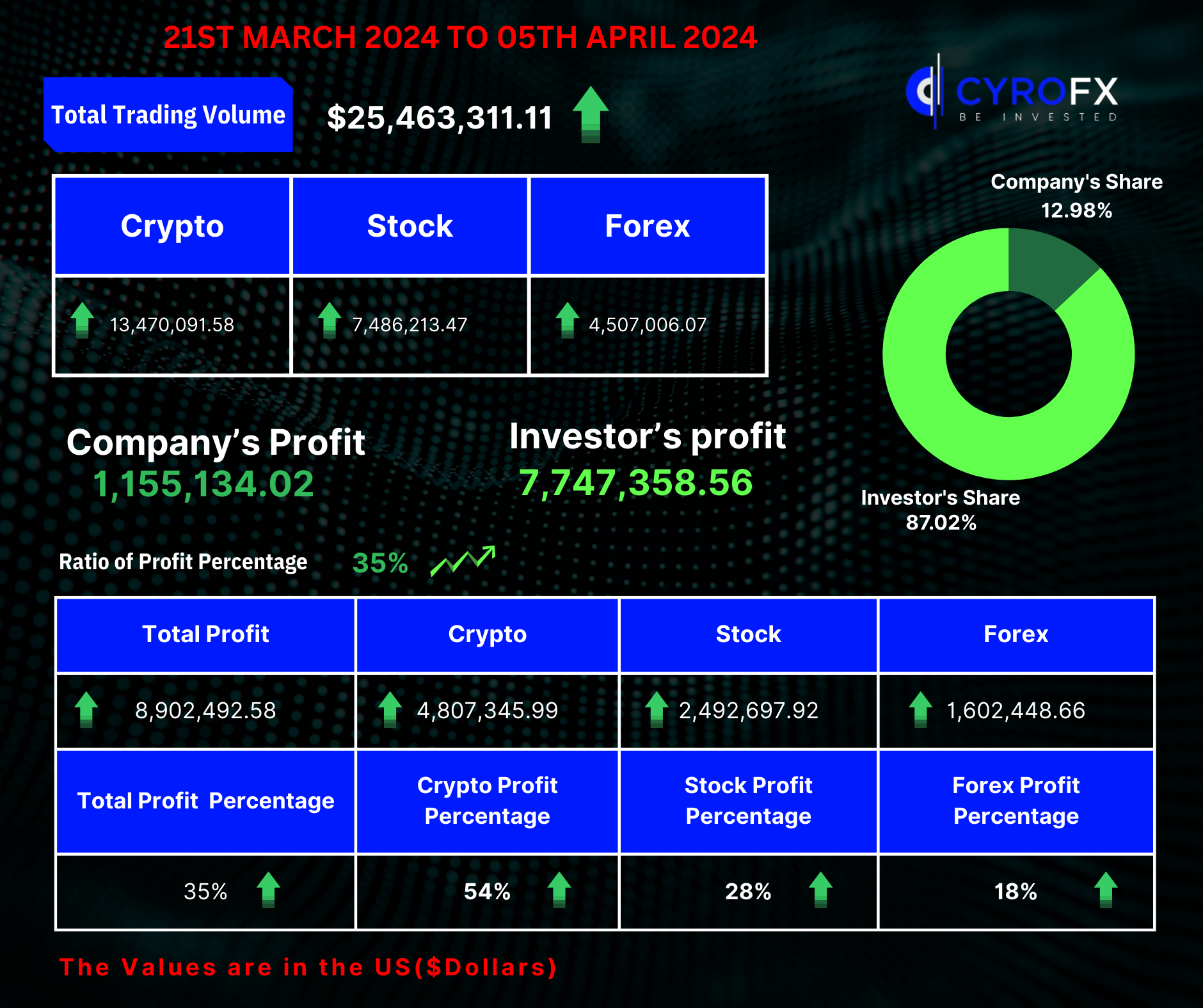

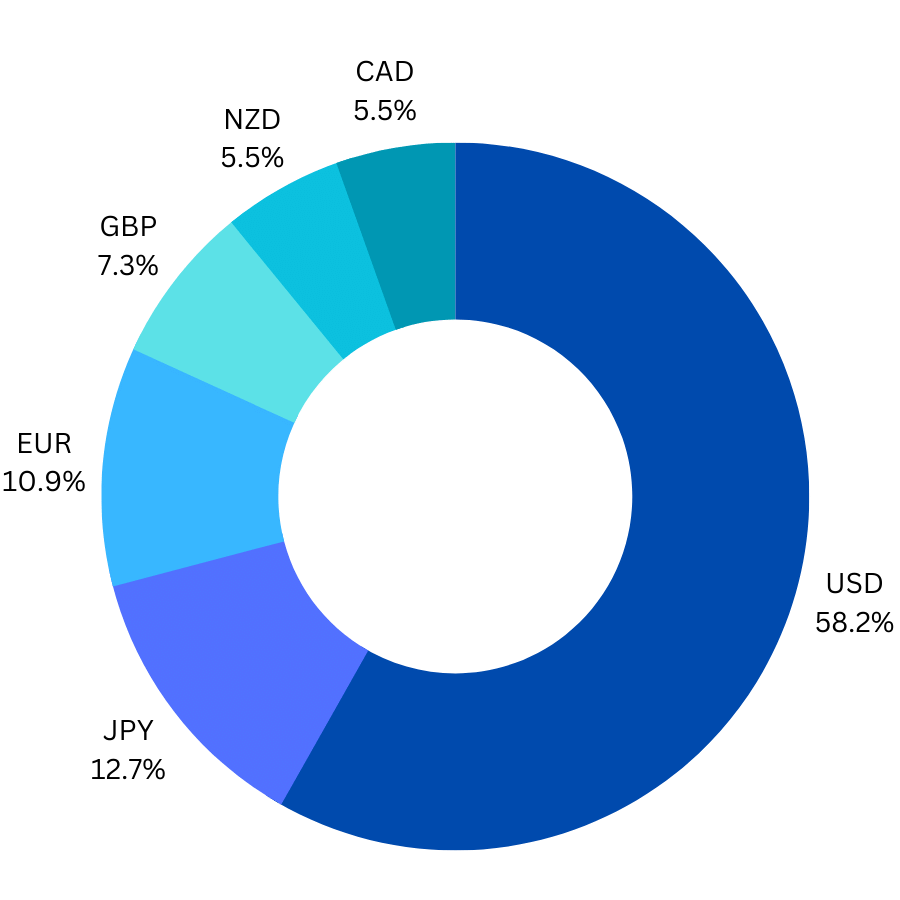

The U.S. Dollar Index (USDX) is a measurement of the value of the United States dollar relative to a basket of foreign currencies. It's often used as an indicator of the dollar's overall strength or weakness in the global currency markets. Trading the U.S. Dollar Index involves speculating on the value of the U.S. dollar relative to a basket of major world currencies. Here's a basic overview of how USDX trading works:

-

Understanding

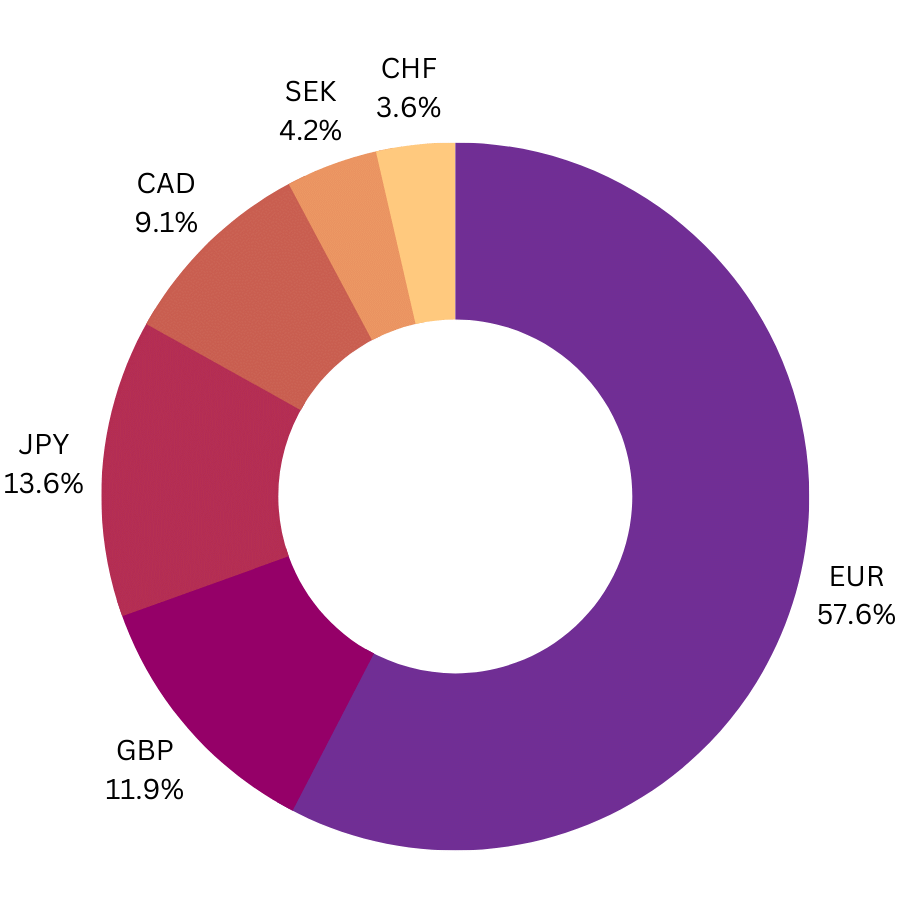

Understanding the Index

The USDX is a weighted geometric mean of the dollar's value compared to six major currencies: Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Canadian Dollar (CAD), Swedish Krona (SEK), and Swiss Franc (CHF).

-

Price Quotation

Price Quotation

The USDX is typically quoted as a value. For example, if the USDX is at 95.00, it means the dollar's value is relative to the basket of currencies. If the USDX rises to 96.00, it suggests the dollar has strengthened against those currencies.

-

Positions

Long and Short Positions

Traders can take long (buy) or short (sell) positions on the USDX, depending on their market outlook. If a trader expects the dollar to strengthen, they might go long on the USDX. Conversely, if they anticipate dollar weakness, they might go short.

-

Leverage

Leverage

Many trading plaƞorms offer leverage, allowing traders to control a larger position with a smaller amount of capital. While leverage can amplify gains, it also increases the potential for losses.

-

Analysis

Analysis

Traders use fundamental and technical analysis to make informed decisions. Fundamental analysis involves evaluating economic data, interest rate differentials, and geopolitical factors affecting the dollar and the other currencies in the basket. Technical analysis involves studying price charts and using indicators to identify potential trends and entry/exit points.

Japanese Yen currency index

The Japanese Yen Currency Index is a metric that measures the value of the Japanese yen (JPY) relative to a group of other major currencies. Similar to other currency indices, this index provides insights into the performance of the Japanese yen against its key trading partners' currencies.

-

Introduction

Introduction

Introduce the Japanese Yen Currency Index as a vital tool in the foreign exchange market. Highlight its role in measuring the Japanese Yen's value relative to a basket of other major currencies.

-

Purpose

Purpose and Definition

Define the Japanese Yen Currency Index as a hypothetical benchmark that gauges the Yen's strength against a collection of key trading partner currencies. Explain that it provides insights into the Yen's competitiveness and its position on the global forex stage.

-

Composition

Composition and Selection

Discuss the currencies that typically form the index's basket, often chosen based on the volume of trade between Japan and its major partners. Distribution by Weight 1 EUR 2 GBP 3 JPY 4 CAD 5 SEK 6 CHF Emphasize that these currencies reflect the international trade dynamics impacting the Yen's value.

-

Calculation

Calculation Methodology

Briefly explain how the index is calculated, involving a weighted average of the Yen's exchange rates against the chosen basket of currencies. Mention that each currency's weight is determined by its significance in Japan's international trade.

-

Significance

Significance and Insights

Highlight the importance of the index in assessing the Yen's relative strength. Explain that a rising index may indicate Yen appreciation, influencing export competitiveness and potentially impacting monetary policy decisions.

The Australian Dollar Currency Index

The Australian Dollar currency index is a theoretical metric that could be designed to gauge the performance of the Australian dollar (AUD) in relation to a basket of major global currencies. The index's primary function would be to offer insights into how the Australian dollar is faring when compared to the currencies of its trading partners.

-

Introduction

Introduction

Introduce the idea of an Australian Dollar Currency Index. Explain that this index measures the performance of the Australian Dollar against a selection of major international currencies.

-

Purpose

Purpose and Definition

Define the Australian Dollar Currency Index as a composite measure reflecting the AUD's relative value compared to other significant global currencies. Highlight its role in providing insights into the Australian Dollar's strength in international trade.

-

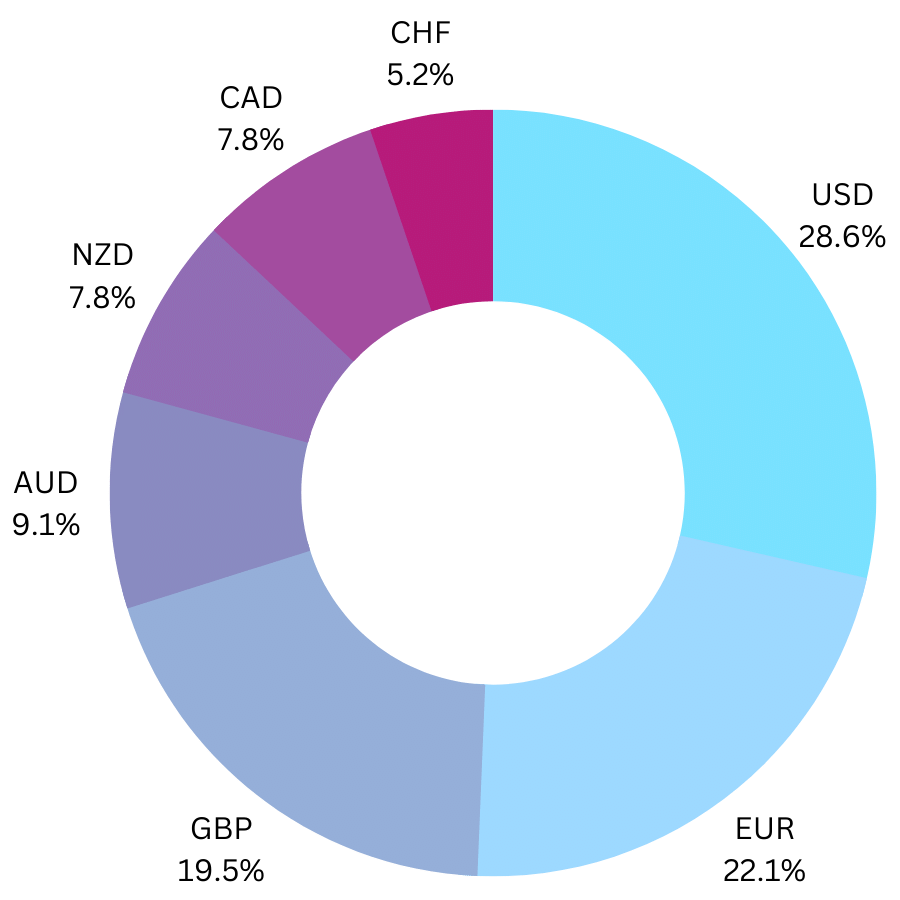

Composition

Composition and Selection

Discuss the currencies included in the index's basket, typically chosen based on the volume of trade and economic relationships between Australia and its major trading partners. Emphasize the diverse range of currencies that contribute to the index's calculation.

-

Weighting

Weighting Methodology

Explain the weighting methodology used to calculate the index, which considers the significance of each currency in Australia's trade activities. Describe how larger trading partners' currencies might carry more weight, reflecting their greater impact on the Australian economy.

-

Calculation

Calculation and Interpretation

Provide an overview of how the Australian Dollar Currency Index is calculated using the weighted average of exchange rates. Explain that changes in the index value indicate shifts in the AUD's performance against the chosen basket of currencies.

Other Forex Indices

Here are the other indices that we deal with in Stock Market