More Option

B10

The Crypto Market Index is an index for the top 10 crypto coins or tokens in terms of market capitalization, and it tracks the top blockchain projects. The Crypto Market Index B10 is widely considered the benchmark index for the cryptocurrency market. Each crypto index in B10 is composed of a selection of cryptocurrencies that are grouped together and weighted by market capitalization. The market capitalization of a cryptocurrency is calculated simply by multiplying the number of units of a specific coin by its current market value against the US dollar.

-

Diversification

Diversification

Trading a crypto index allows you to gain exposure to a diverse range of cryptocurrencies, which can help spread risk across the market.

-

Efficiency

Efficiency

Instead of trading individual cryptocurrencies, trading an index can be more efficient in terms of time and effort required for research and management.

-

Trends

Trends

Crypto indices can provide insights into the overall trend of the cryptocurrency market, helping traders identify broader market movements.

-

Reduced Volatility

Reduced Volatility

A well-constructed index can potentially reduce the impact of extreme price fluctuations in individual cryptocurrencies.

-

Liquidity

Liquidity

Some crypto indices may offer higher liquidity compared to trading lessestablished individual tokens.

NASDAQ Crypto index

The NASDAQ Crypto Index, also known as "NCI," is a digital asset index introduced by Nasdaq. It is designed to provide investors with a comprehensive view of the cryptocurrency market by tracking the performance of a select group of cryptocurrencies. This index includes various cryptocurrencies that are considered significant in terms of market capitalization, liquidity, and overall influence on the crypto market. The NCI aims to offer investors insights into the broader trends and movements within the cryptocurrency space, similar to how traditional stock market indices provide insights into the broader stock market.

-

Introduction

Introduction

The NASDAQ Crypto Index is a benchmark designed to measure and track the performance of the cryptocurrency market. It is established by NASDAQ. Similar to other indices, it aims to provide investors and traders with insights into the overall trends and movements within the cryptocurrency space.

-

Purpose and Definition

Purpose and Definition

The purpose of the NASDAQ Crypto Index is to serve as a tool for evaluating the performance of the cryptocurrency market as a whole. It helps investors and market participants gauge the health of the digital asset sector, track changes over time, and make informed decisions based on market trends.

-

Composition

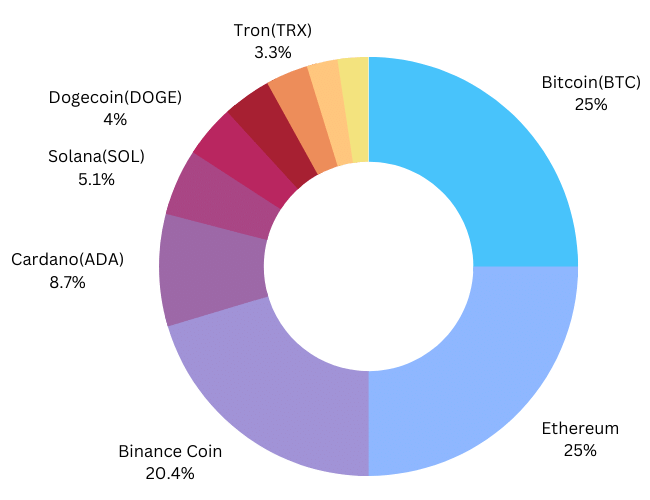

Composition and Selection

The NASDAQ index is composed of a selection of cryptocurrencies that are considered representative of the broader cryptocurrency market. The specific cryptocurrencies included in the index can vary based on certain criteria such as market capitalization, liquidity, and relevance. This composition ensures that the index provides a comprehensive view of the cryptocurrency market's performance.

-

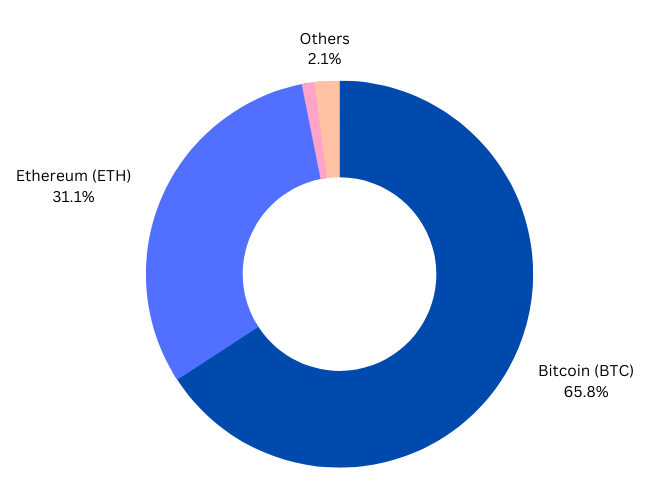

Weighting Methodology

Weighting Methodology

The weighting methodology determines the influence of each cryptocurrency in the NASDAQ index's overall performance. This can be market-capitalization-weighted, price-weighted, or other methods. A market-capitalization-weighted approach gives greater importance to cryptocurrencies with higher market capitalizations, reflecting their larger significance in the market.

-

Calculation

Calculation and Interpretation

The index value is calculated based on the prices or market capitalizations of the cryptocurrencies within it. Changes in the prices or market capitalizations of the individual cryptocurrencies will impact the overall index value. The index is often calculated in real-time and published at regular intervals, allowing market participants to monitor its performance.

NYSE Bitcoin index

The NYSE Bitcoin Index (NYXBT) was designed to provide real-time tracking of the price of Bitcoin, one of the most popular and widely recognized cryptocurrencies. The index aimed to offer traditional financial market participants, such as institutional investors, traders, and regulators, a reliable reference point for monitoring the price movements of Bitcoin.

-

Introduction

Introduction

Introduce the concept of the Crypto 100 Index as a potential benchmark for tracking the performance of the top 100 cryptocurrencies in the market.

-

Purpose and Definition

Purpose and Definition

Define the Crypto 100 Index as a composite measure that reflects the combined performance of a diversified selection of the most prominent cryptocurrencies.

-

Composition

Composition and Selection

Discuss the process of selecting the cryptocurrencies included in the index's basket. Emphasize the importance of a diversified mix to capture the various sectors and trends within the cryptocurrency ecosystem.

-

Weighting Methodology

Weighting Methodology

Explain the potential weighting methodology used to calculate the index, which might consider factors like market capitalization, trading volume, and project fundamentals. Describe how the weighting ensures that larger cryptocurrencies carry more influence over the index's movements.

-

Calculation

Calculation & Interpretation

Provide an overview of how the Crypto 100 Index is calculated using the weighted average of the selected cryptocurrencies' price movements. Explain that changes in the index value represent shifts in the collective performance of the top 100 cryptocurrencies.

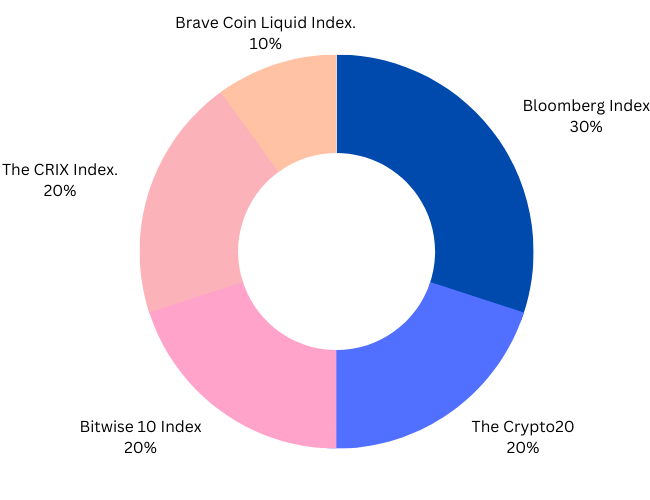

Other Crypto Indices

Here are the other indices that we deal with in Crypto Market